Invoice Discounting: An Overview

As a business owner, you know that managing cash flow can be a real challenge. One solution that many companies turn to is invoice discounting. This financial tool allows businesses to borrow money against their outstanding invoices, providing them with access to funds they may not have otherwise. In this article, we will explore what invoice discounting is, how it works, and the pros and cons of this financing option.

What is Invoice Discounting?

Invoice discounting, also known as invoice financing or accounts receivable financing, is a financial tool that allows businesses to borrow money against their outstanding invoices. Essentially, the business sells its unpaid invoices to a lender in exchange for a cash advance. The lender will typically advance a percentage of the value of the invoices, usually around 80-90%.

How Does Invoice Discounting Work?

Here’s how the process typically works:

- A business sells goods or services to its customers and issues invoices with payment terms.

- The business then sells these unpaid invoices to a lender (the invoice discounter) at a discount.

- The invoice discounter pays the business a percentage of the value of the invoices upfront, usually around 80-90%.

- The lender collects payment from the customers when the invoices are due, and deducts its fee from the remaining amount.

- Any remaining balance is paid to the business.

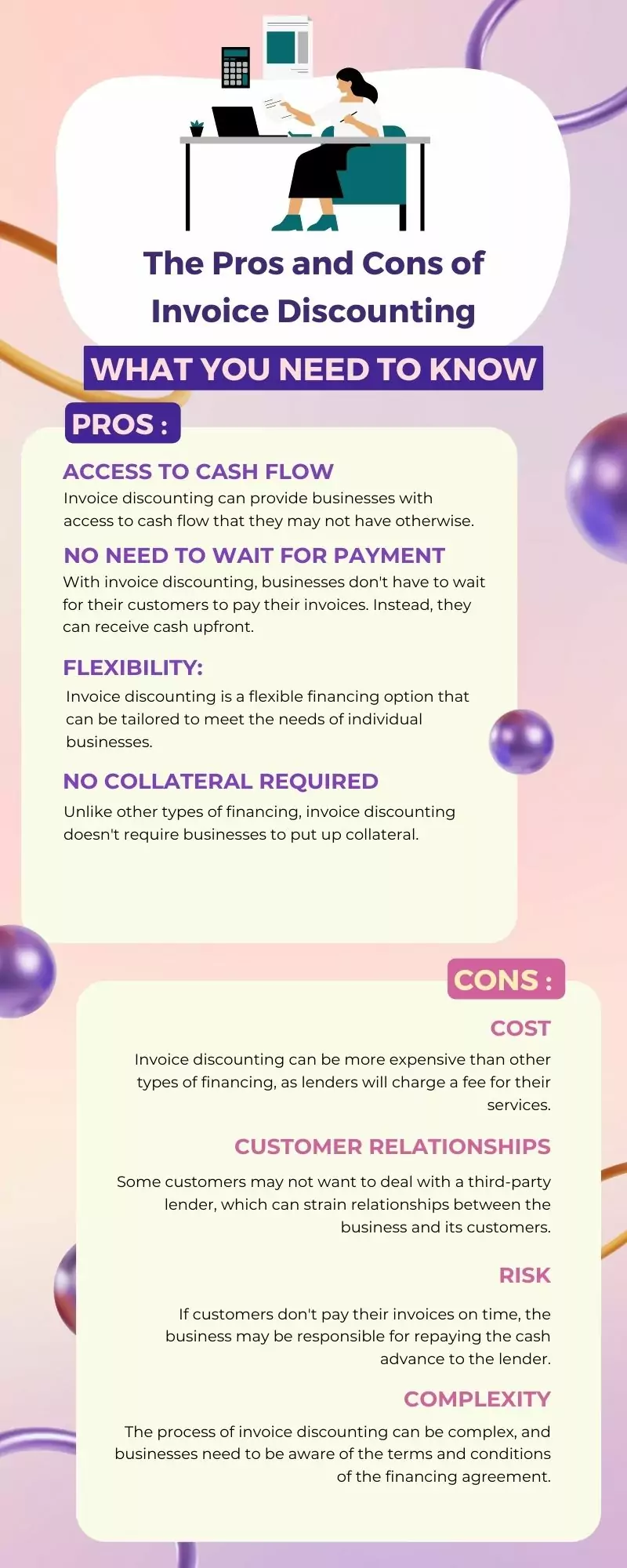

Pros and Cons of Invoice Discounting

Like any financial tool, invoice discounting has its pros and cons. Here are some of the main advantages and disadvantages to consider:

Pros:

- Access to cash flow: Invoice discounting can provide businesses with access to cash flow that they may not have otherwise.

- No need to wait for payment: With invoice discounting, businesses don’t have to wait for their customers to pay their invoices. Instead, they can receive cash upfront.

- Flexibility: Invoice discounting is a flexible financing option that can be tailored to meet the needs of individual businesses.

- No collateral required: Unlike other types of financing, invoice discounting doesn’t require businesses to put up collateral.

Cons:

- Cost: Invoice discounting can be more expensive than other types of financing, as lenders will charge a fee for their services.

- Customer relationships: Some customers may not want to deal with a third-party lender, which can strain relationships between the business and its customers.

- Risk: If customers don’t pay their invoices on time, the business may be responsible for repaying the cash advance to the lender.

- Complexity: The process of invoice discounting can be complex, and businesses need to be aware of the terms and conditions of the financing agreement.

Who Should Use Invoice Discounting?

Invoice discounting can be a useful tool for businesses that need to manage their cash flow. It’s particularly useful for businesses that have long payment terms with their customers, as it can provide them with access to cash flow that they may not have otherwise.

However, invoice discounting may not be suitable for all businesses. For example, businesses that have a high level of bad debt may find it difficult to secure financing through invoice discounting.

Conclusion

Invoice discounting can be a useful tool for businesses that need to manage their cash flow. It provides businesses with access to funds that they may not have otherwise, allowing them to maintain operations and invest in growth. However, it’s important to carefully consider the pros and cons of invoice discounting before deciding whether it’s the right financing option for your business.

FAQs

- How is invoice discounting different from factoring?

Invoice discounting and factoring are similar financing options that allow businesses to access cash flow by borrowing against their outstanding invoices. However, there are some key differences. With invoice discounting, the business retains control of its sales ledger and is responsible for collecting payment from customers. With factoring, the lender takes over the management of the sales ledger and collects payment from customers directly.

- Can all businesses use invoice discounting?

While many businesses can benefit from invoice discounting, it may not be suitable for all businesses. Businesses that have a high level of bad debt or a small number of customers may find it difficult to secure financing through invoice discounting.

- How much does invoice discounting cost?

The cost of invoice discounting can vary depending on a number of factors, such as the size of the advance, the creditworthiness of the business, and the lender’s fees. Typically, lenders will charge a fee for their services, which can range from 0.5% to 5% of the value of the invoices.

- What happens if customers don’t pay their invoices?

If customers don’t pay their invoices, the business may be responsible for repaying the cash advance to the lender. This can be a risk for businesses, particularly if they have a high level of bad debt.

- How long does the invoice discounting process take?

The invoice discounting process can vary depending on the lender and the size of the financing agreement. Generally, the process can take anywhere from a few days to a few weeks.

Invoice Discounting Platform in India

Invoice discounting platforms in India are financial technology (fintech) companies that offer a type of working capital financing to businesses. The platform allows businesses to raise funds by selling their outstanding invoices to investors or lenders at a discounted rate. This provides businesses with immediate access to cash flow, which can help them to meet their immediate financial needs.

Some popular invoice discounting platforms in India include KredX, Invoicemart, M1xchange, and Trellis. These platforms offer various services such as invoice factoring, invoice discounting, and invoice financing. They provide an online platform where businesses can upload their invoices and receive funds in a timely manner.

These platforms are becoming increasingly popular in India as they offer a quick and easy way for businesses to obtain financing without the need for collateral or extensive paperwork. However, it is important for businesses to carefully review the terms and conditions of each platform before choosing one to work with.